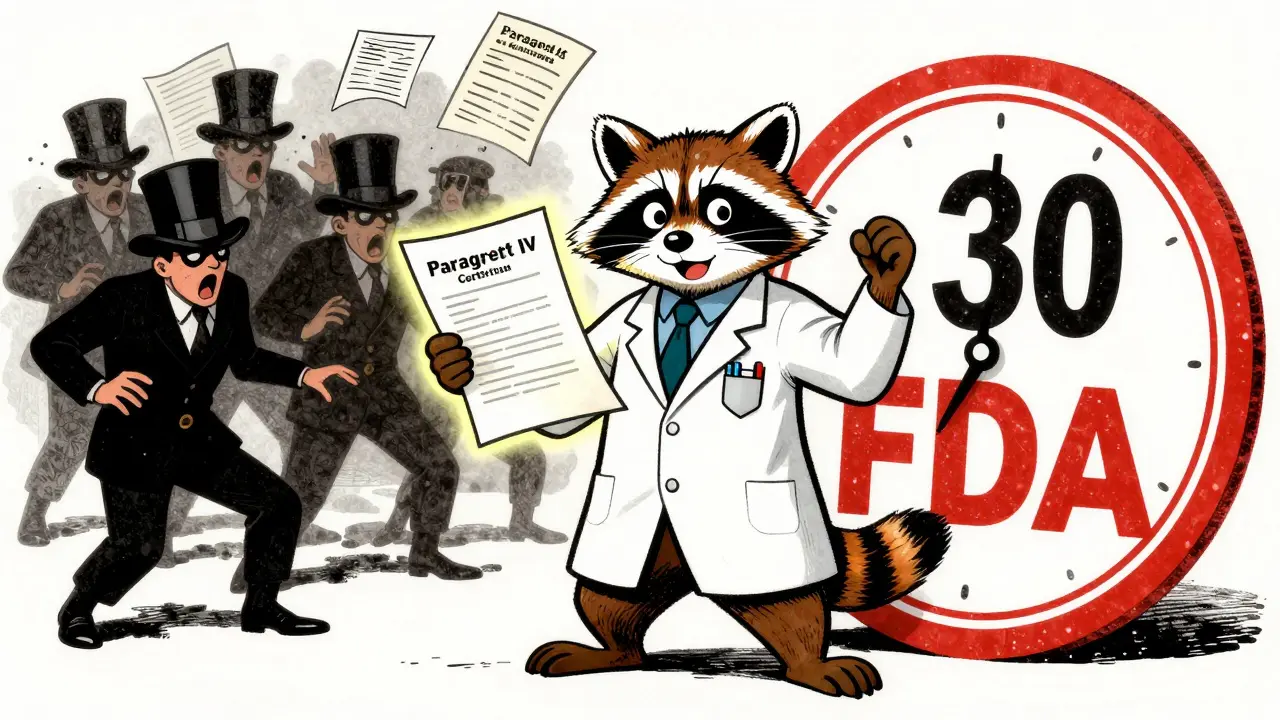

When a generic drug company wants to sell a cheaper version of a brand-name medicine, it doesn’t just wait for the patent to expire. It can legally challenge that patent before the drug even hits the market. That’s the power of a Paragraph IV certification - a high-stakes legal move built into U.S. drug law that lets generic makers fight patents head-on, often years ahead of schedule.

What Exactly Is a Paragraph IV Certification?

It’s a formal statement filed with the FDA as part of an Abbreviated New Drug Application (ANDA). In this statement, the generic company claims that one or more patents listed for the brand drug are either invalid, unenforceable, or won’t be infringed by the generic version. This isn’t a guess. It’s a legal declaration backed by technical and legal analysis. This mechanism comes from the Hatch-Waxman Act of 1984. Before that, brand-name drug makers could block generics indefinitely by holding onto patents, even weak ones. The law changed that. It created a structured way for generics to enter the market early - but only if they were willing to take on the legal risk. The catch? Filing a Paragraph IV certification is treated as an “artificial act of infringement” under federal patent law. That means the brand company can immediately sue. But here’s the twist: the lawsuit happens before the generic drug is sold. That’s the whole point. It avoids chaos in the marketplace. Courts decide patent validity upfront, not after millions of pills are already in circulation.How It Works: The Step-by-Step Process

The process isn’t simple, but it’s predictable. Here’s how it unfolds:- File the ANDA with a Paragraph IV certification: The generic company submits its application to the FDA, including a detailed legal and scientific argument explaining why the patent doesn’t block them.

- Send a notice letter: Within 20 days, the generic company must mail a copy of that certification to the brand-name drug maker and the patent holder. This letter must include the basis for the challenge - not just a summary, but enough detail to show the claim isn’t frivolous.

- Brand company has 45 days to sue: If the brand company believes its patent is being challenged unfairly, it can file a lawsuit in federal court. If they do, the FDA automatically puts a 30-month hold on approving the generic drug. That clock starts the moment the lawsuit is filed.

- Legal battle begins: The case moves through the courts. This can take 2 to 5 years. If the generic wins, the patent is invalidated or found not infringed. If the brand wins, the generic can’t launch until the patent expires.

- Win = 180-day exclusivity: The first company to successfully file a Paragraph IV certification gets 180 days of exclusive rights to sell the generic version. No other generics can enter during that time - even if they have their own approval. That’s a massive financial incentive.

Why Do Companies Take This Risk?

The answer is money - and lots of it. The 180-day exclusivity period can be worth hundreds of millions, sometimes over a billion dollars. Take the case of Apotex challenging GlaxoSmithKline’s Paxil patent in 2004. After winning, Apotex had the exclusive right to sell the generic version. During those 180 days, they earned over $1.2 billion in revenue. That’s why nearly two-thirds of all ANDAs filed today include a Paragraph IV certification. For generic drug makers, it’s not just about competition - it’s their business model. The FDA reports that since 1984, this system has saved U.S. consumers more than $1.7 trillion in drug costs. But it’s not all wins. The median cost of litigating a Paragraph IV case is $12.7 million. Some cases exceed $15 million. And if you lose? You’re out that money, and you’re still blocked from the market.

What Happens If You Mess Up?

One small mistake can cost you the 180-day exclusivity - and your entire investment. Teva learned this the hard way in 2017 with its Copaxone generic. They filed a Paragraph IV challenge, won the lawsuit, and got FDA approval. But they didn’t get “tentative approval” within 30 months of filing. That triggered a forfeiture rule. As soon as their drug was approved, five other generic companies jumped in. Their 180-day window vanished overnight. Even the notice letter can be a trap. The FDA rejected 12% of Paragraph IV applications in 2021-2022 because the legal basis in the notice letter wasn’t detailed enough. Courts don’t require a perfect legal brief - just enough to show the challenge is grounded in fact and law. But if it’s vague, the FDA will reject the whole application.How Does This Compare to Other Patent Certifications?

There are four types of patent certifications under Hatch-Waxman. Paragraph IV is the only one that triggers litigation.- Paragraph I: “This drug isn’t patented.” Only about 5% of applications use this. Low risk, no reward.

- Paragraph II: “The patent expired.” Used in 15% of cases. Safe, simple, no lawsuit.

- Paragraph III: “We’ll wait until the patent expires.” About 20% of filings. No rush, no risk, no exclusivity.

- Paragraph IV: “We’re challenging this patent.” 60-70% of applications. High risk, high reward.

Big Trends Changing the Game

The landscape is shifting. Brand companies are filing more patents - sometimes dozens - on minor changes to a drug’s formulation, dosage, or delivery method. This is called “patent thickets.” It’s designed to make Paragraph IV challenges harder and more expensive. In response, generic makers are now combining Paragraph IV lawsuits with Inter Partes Review (IPR) proceedings at the Patent Trial and Appeal Board. In 2022-2023, 42% of Paragraph IV cases had parallel IPR challenges. This dual-track strategy increases pressure on brand companies and raises the cost of defending weak patents. Another big change came in 2023 with the Supreme Court’s Amgen v. Sanofi decision. The court raised the bar for patent validity, requiring that a patent must enable anyone skilled in the field to make and use the full scope of the invention. That’s making it harder to win Paragraph IV challenges on broad biologic patents. And then there’s “authorized generics” - when the brand company launches its own generic version during the 180-day exclusivity window. The FTC has been fighting this since 2021, calling it anti-competitive. In the Shire case, the FTC argued this tactic undermines the whole point of the exclusivity period.Is This System Still Working?

Yes - but it’s under pressure. The Congressional Budget Office estimates Paragraph IV challenges will continue saving $150-200 billion annually in healthcare costs through 2030. That’s why lawmakers still support it. But experts warn the system is being stretched. The cost of litigation is rising. Patent thickets are growing. And settlements between brand and generic companies - known as “pay-for-delay” deals - still happen. In these deals, the brand pays the generic to delay entry. The FTC found 197 such deals between 1999 and 2009. Courts have ruled many of them illegal, but they still occur. The FDA’s 2024 Orange Book Modernization Act aims to fix this by making patent listings more accurate and reducing the ability to list weak patents. That’s a step in the right direction.What’s Next for Generic Drug Makers?

The future belongs to companies that play smart. That means:- Starting patent research 3-4 years before the brand patent expires.

- Working with specialized patent attorneys who know the fine print.

- Using IPR and other PTAB tools alongside court challenges.

- Targeting patents with clear weaknesses - not just any patent.

- Getting the notice letter exactly right - no shortcuts.

What happens if a generic company loses a Paragraph IV lawsuit?

If the generic company loses the lawsuit, they cannot launch their drug until the patent expires. They also lose the chance to claim the 180-day marketing exclusivity. Any money spent on litigation is lost, and they’re barred from entering the market during the patent term. Some companies may try again later with a different challenge, but only if new patents or legal grounds emerge.

Can a brand company stop a Paragraph IV challenge before it goes to court?

Yes, through settlement. Many brand companies offer deals to generic makers to delay market entry in exchange for payment or a share of future profits. These are called “pay-for-delay” agreements. While the FTC and courts have ruled many of these illegal, they still happen. The 2013 Supreme Court case FTC v. Actavis made it clear that such deals can violate antitrust laws if they’re designed solely to block competition.

Why is the 180-day exclusivity period so valuable?

Because during those 180 days, no other generic company can sell the same drug - even if they’ve already gotten FDA approval. That means the first filer captures nearly all of the generic market share. For a blockbuster drug like a $2 billion annual seller, that exclusivity can be worth $500 million or more in revenue. It’s the only time a generic company can charge near-brand prices before competitors drop prices further.

Does the FDA approve the Paragraph IV challenge itself?

No. The FDA only checks that the certification is properly filed and that the notice letter meets basic requirements. The legal validity of the challenge - whether the patent is truly invalid or not infringed - is decided by a federal court. The FDA doesn’t evaluate the science or law behind the claim. It’s purely a procedural gatekeeper.

How long does a Paragraph IV lawsuit typically take?

Most Paragraph IV lawsuits take between 2 and 5 years to resolve. The 30-month stay gives the FDA a deadline to wait, but courts often extend the timeline if the case is complex. Some cases settle before trial. Others go to trial and are appealed. The clock doesn’t stop just because the FDA has approved the drug - approval is blocked until the legal dispute is resolved.

Alexandra Enns

January 25, 2026 AT 17:19This whole Paragraph IV system is a joke. Canada doesn't let pharma companies play these games - we get cheap drugs without the legal circus. The US is just letting Big Pharma bully generics into submission with patent thickets and 30-month delays. It's not innovation, it's extortion. And don't even get me started on those pay-for-delay schemes - they're not settlements, they're bribes with law degrees.

Marie-Pier D.

January 25, 2026 AT 23:04Wow, this is actually so important and I’m glad someone explained it clearly 😊 I’ve been on so many meds and never knew how the generics got approved so fast. This whole system feels like a secret superhero move for patients - risky for the companies, but life-changing for us. Thank you for breaking it down like this 💙

Viola Li

January 26, 2026 AT 19:06Let’s be real - if you’re filing a Paragraph IV, you’re not challenging patents, you’re gambling with other people’s health. You think you’re a hero for lowering prices? You’re just exploiting loopholes while doctors and patients pay the price in uncertainty. This isn’t free market - it’s legalized chaos.

Dolores Rider

January 28, 2026 AT 01:33They’re hiding something. Why does the FDA even let this happen? I’ve read that 70% of these challenges come from just 3 big generic companies - and guess what? They all have ties to the same offshore shell corporations. This isn’t competition, it’s a cartel disguised as innovation. The government knows. They just don’t care. 💀

Jenna Allison

January 28, 2026 AT 17:30For anyone new to this - think of Paragraph IV like a legal Hail Mary. The generic company has to prove the patent is either invalid (never should’ve been granted) or not infringed (their drug doesn’t actually violate it). The FDA doesn’t judge that - courts do. And the 180-day exclusivity? That’s the reward for winning the legal war. But here’s the kicker: if you mess up the notice letter, you lose everything. Even a missing comma can trigger forfeiture. It’s insane how precise this has to be.

Vatsal Patel

January 29, 2026 AT 23:40Ah yes, the great American paradox: we worship innovation while punishing those who dare to innovate within the system. The brand companies cry "intellectual property!" while stacking patents like Jenga blocks - one for the color of the pill, one for the shape, one for the time you take it. And the generics? They’re the only ones brave enough to knock the tower down. Who’s the real thief here? The one who sees the fraud… or the one who built it?

Himanshu Singh

January 31, 2026 AT 14:44This is actually beautiful when you think about it. A system that says: "You believe this patent is wrong? Prove it. And if you do, you get to help millions get medicine at a fraction of the cost." It’s not perfect, but it’s one of the few places where law and public good actually align. Keep fighting the good fight, generic companies. You’re doing the work the system was meant to do 🙏

Jamie Hooper

February 2, 2026 AT 05:03so like… if you file a paragraph iv and then the brand sues, you just chill for 30 months? that’s wild. i thought the whole point was to get the drug out fast. also why do they even have to mail a letter? why not email? is this 1998? 😅

Husain Atther

February 2, 2026 AT 05:32It’s fascinating how this system balances competing interests - innovation, access, and legal integrity. While the process is complex and costly, the net benefit to society is undeniable. The key lies in maintaining transparency and preventing abuse, such as patent thickets or pay-for-delay arrangements. With thoughtful reform, this model can continue to serve patients for decades to come.