It’s December 2025, and hospitals across the U.S. and Europe are rationing life-saving medications. Insulin, antibiotics, cancer drugs - all in short supply. Not because of a pandemic or a factory fire. But because the system that makes them relies too heavily on a few countries halfway across the world. The truth is, foreign manufacturing isn’t just a cost-saving trick anymore. It’s a ticking time bomb for public health.

How We Got Here

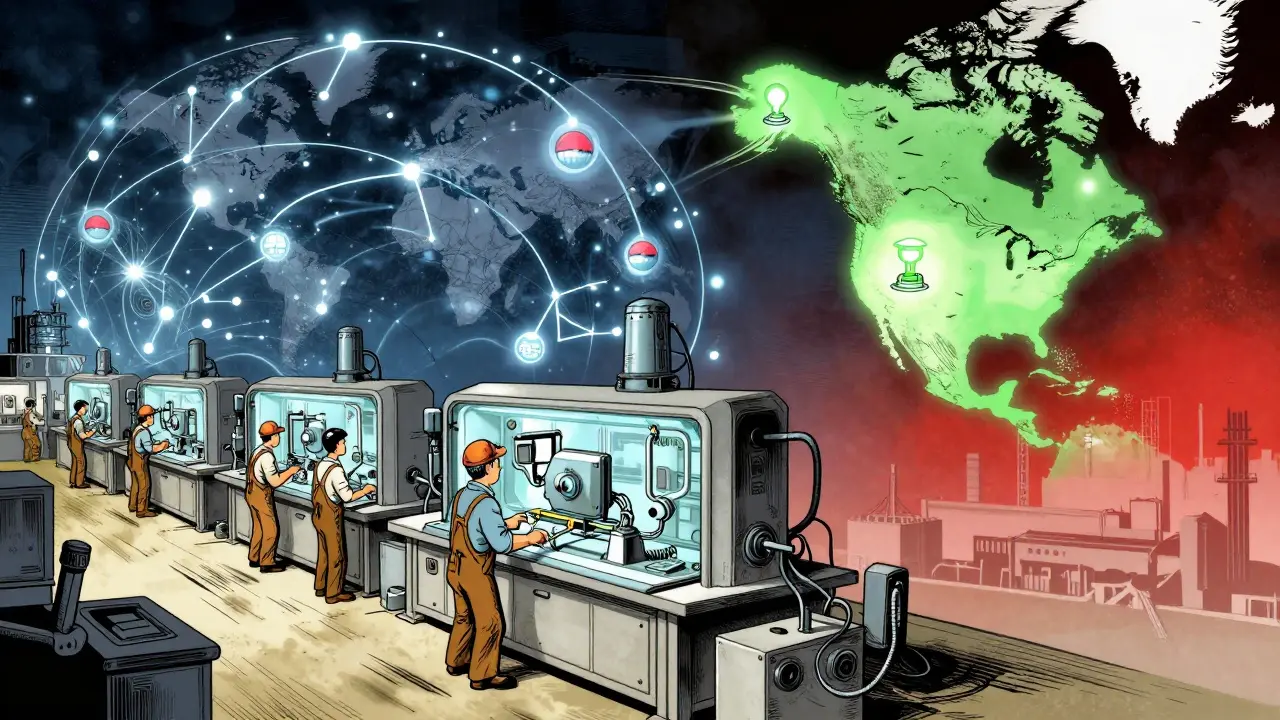

In the 1990s and 2000s, pharmaceutical companies didn’t just outsource production - they handed over the entire supply chain. Active pharmaceutical ingredients (APIs), the core chemical components of drugs, went from being made in the U.S. and Europe to factories in China and India. Why? Because it was cheaper. Much cheaper. Labor costs in China were a fraction of what they were in the West. Regulations were looser. Scale was massive. By 2025, over 80% of APIs used in American medicines come from China or India. For some critical drugs - like heparin, penicillin, and corticosteroids - that number jumps to 95%. The U.S. doesn’t even have enough domestic capacity to make half the APIs it needs. And it’s not just pills. IV bags, syringes, even the plastic tubing used in dialysis machines? Most are made overseas. This wasn’t a sudden decision. It was a slow, quiet shift over decades. Companies focused on quarterly profits. Regulators didn’t demand transparency. Governments didn’t see it as a national security issue - until it was too late.The Breaking Point

In 2024, a port strike in Shanghai shut down shipments for 18 days. A heatwave in India damaged raw material storage. A cyberattack on a key API supplier in Gujarat froze production for six weeks. These weren’t disasters. They were routine. The result? Drug shortages spiked 47% in 2024 compared to 2023. The FDA recorded over 300 active shortages by mid-year - the highest since the pandemic. And it wasn’t just rare drugs. Common ones like amoxicillin, metformin, and even aspirin became hard to find. Pharmacies started limiting prescriptions. Patients skipped doses. Emergency rooms had to switch to less effective alternatives. Why does a delay in China affect a patient in Bristol? Because the system has no backup. No buffer. No plan B. Companies operate on just-in-time inventory - meaning they order exactly what they need, when they need it. One delay, one customs hold, one tariff change, and the whole chain snaps.The Cost of Convenience

The savings looked good on paper. A single API made in China cost 60% less than the same one made in the U.S. But those savings came with hidden price tags. Logistics costs have jumped 50% since 2019. Shipping a container from Shanghai to Los Angeles now takes 30% longer than it did before the pandemic. Insurance premiums for shipments have doubled. And then there are tariffs. In 2024, the U.S. slapped new duties on $340 billion worth of Chinese imports - including pharmaceuticals. That meant manufacturers either paid more or passed the cost to consumers. But the real cost? Lives. A 2025 study from the American Medical Association found that patients in areas with chronic drug shortages were 23% more likely to be hospitalized for preventable complications. For diabetics without insulin, that’s not a statistic - it’s a death sentence.

Who’s Fixing It?

Some companies are waking up. A Fortune 500 medical device maker near Pittsburgh switched from relying on a single supplier in China to using dual sources - one in Mexico, one in Poland. They spent $2.3 million and 18 months to retool. Now, their on-time delivery rate is 99.2%. No more panic calls from hospitals. Others are turning to nearshoring. Mexico is becoming a hotspot. Labor costs there are still 40% lower than in the U.S., but shipping time drops from 30 days to 5. The U.S.-Mexico-Canada Agreement renegotiations in early 2025 made this even easier, with clearer rules and lower tariffs. Then there’s the tech shift. AI-powered forecasting now helps companies predict disruptions before they happen. Digital twins - virtual models of entire supply chains - let firms simulate what happens if a factory in India shuts down. One company in Ohio used this to reroute production within 72 hours during a 2024 flood. But these fixes aren’t cheap. Setting up a microfactory in the U.S. that can produce APIs locally costs 40% more upfront than buying from China. And most small drugmakers can’t afford it.The Bigger Picture

This isn’t just about drugs. It’s about trust. When your medicine comes from a country you don’t control - and whose policies you can’t predict - you’re gambling with your health. China’s export controls on rare earth metals and pharmaceutical ingredients have already been used as political tools. In 2024, India restricted exports of certain APIs after domestic shortages. These aren’t anomalies. They’re signals. The World Economic Forum warned in its 2025 Global Risks Report that supply chain disruptions from geopolitics, climate events, and cyberattacks are converging into systemic shocks. And the smallest players - community pharmacies, rural hospitals, low-income patients - get crushed first.

What Can Be Done?

There’s no magic fix. But here’s what’s working:- Diversify suppliers - Don’t rely on one country. Use two or three across different regions.

- Build inventory buffers - Keep 30-60 days of critical drugs on hand. It’s expensive, but cheaper than a hospital crisis.

- Invest in domestic capacity - The U.S. Inflation Reduction Act allocated $1.5 billion for domestic API production. It’s a start.

- Use blockchain for tracking - Companies using blockchain to verify API sources report 65% fewer quality disputes.

- Pressure policymakers - Governments need to treat pharmaceutical supply chains like infrastructure - not just commerce.

What’s Next?

By 2027, experts predict that 50% of pharmaceutical companies will have moved away from single-source foreign manufacturing. The question isn’t whether this shift will happen. It’s whether it’ll happen fast enough to save lives. Right now, the system is still fragile. One storm. One policy change. One cyberattack. And the shelves go empty again. We’ve spent decades optimizing for cheap. Now we’re paying for it in pain.Why are drug shortages getting worse even though supply chains are improving?

Improvements in logistics and forecasting have reduced overall supply chain losses by 88% since 2022. But pharmaceutical supply chains are uniquely vulnerable. Unlike electronics or clothing, drugs can’t be easily switched out. If a single API factory shuts down, there’s no substitute. Plus, most companies still rely on just-in-time inventory, leaving no room for error. Even small delays cascade into full shortages.

Is the U.S. building more drug manufacturing at home?

Yes, but slowly. The U.S. government has invested $1.5 billion since 2022 to restart domestic API production. Five new facilities are under construction in Ohio, North Carolina, and Pennsylvania. But building a single plant takes 3-5 years and costs over $200 million. Most private companies won’t invest without guaranteed contracts. The pace is too slow to meet current demand.

Why not just make everything in the U.S. or Europe?

Cost is the main barrier. Manufacturing a batch of antibiotics in the U.S. costs 4.8 times more than in China. Labor, energy, and environmental compliance add up. Also, the global supply chain is built on specialization - India makes generic APIs, China handles complex synthetics, and the U.S. focuses on innovation. Rebuilding everything domestically would take decades and cost trillions. The goal now isn’t full reshoring - it’s strategic diversification.

How does nearshoring to Mexico help with drug shortages?

Mexico cuts shipping time from 30 days to under 5 days and reduces transport costs by 30-40%. It also shares similar regulatory standards with the U.S., making FDA approval easier. Companies like Johnson & Johnson and Pfizer have shifted 15-20% of their API production to Mexico. This gives them a reliable backup if China or India face disruptions - without the massive cost of U.S. reshoring.

Can AI really prevent drug shortages?

Absolutely. AI tools now analyze weather, political unrest, port congestion, and supplier financial health to predict disruptions weeks in advance. One U.S. pharmaceutical distributor used AI to detect a factory shutdown in India 11 days before it happened. They rerouted production to a Mexican partner and avoided a 6-week shortage. Adoption of AI in supply chain management jumped from 22% in 2020 to 68% in 2025 - and it’s saving lives.

What’s the biggest risk right now for pharmaceutical supply chains?

Workforce shortages. One-third of global pharmaceutical companies report not having enough staff trained in international logistics, customs compliance, and supply chain risk management. Even with all the tech and money in the world, if no one knows how to run the system, it breaks. This is the quiet crisis no one talks about - but it’s slowing down every recovery effort.

Should I be worried about my prescriptions?

If you take a generic drug - especially for diabetes, blood pressure, or infection - yes. Over 60% of generic medications rely on APIs made overseas. Talk to your pharmacist. Ask if your drug has a backup source. Consider switching to a brand-name version if it’s available and affordable - they often have more stable supply chains. And if you’re on a long-term medication, ask your doctor about keeping a 30-day emergency supply on hand.

Gloria Parraz

December 18, 2025 AT 03:13This isn't just about drugs-it's about survival. I had a friend who missed her insulin dose for three days because the pharmacy ran out. She ended up in the ER. This isn't abstract. It's personal. And it's happening to thousands every week.

Companies got lazy. Governments looked the other way. Now we're paying with lives. We need to treat medicine like water or electricity-something we can't afford to lose.

I don't care if it costs more. I'd rather pay $10 more for a prescription than bury someone because we were too cheap to build a backup.

Nicole Rutherford

December 18, 2025 AT 07:10Of course it's China. Always China. They've been poisoning our medicine for years. You think they don't control the supply on purpose? They know we're addicted. They wait until someone's sick and then they hold it hostage.

And don't even get me started on India. Those factories are running on dirt and hope. One guy with a clipboard and a flashlight is inspecting entire batches. No wonder half the pills are fake.

Chris Clark

December 18, 2025 AT 16:10Real talk-I work in a small pharmacy in rural Ohio. We’ve had to switch patients from metformin to a different brand three times this year because the Chinese batch got delayed. No one tells you this stuff until you’re standing there with a mom crying because her kid can’t get his asthma inhaler.

And yeah, Mexico is a game changer. We’ve started ordering from a supplier there for 3 of our top 5 meds. Shipping’s faster, the docs are legit, and the price? Only 15% higher than China. Worth it.

Also, AI tools? We’re using one now. It flagged a supplier in Gujarat last month because their power bills dropped. Turns out their generator died. We switched before they even told us. Saved us 2 weeks.

Guillaume VanderEst

December 19, 2025 AT 19:08Canada’s been here for years. We’ve got our own API plants, but we’re still tied to the global mess. We lost access to heparin for six weeks last winter because of a port strike in Shanghai. Our ICU had to use animal-derived alternatives. No joke. A cow’s intestine in a human vein.

It’s not just about cost. It’s about dignity. When you’re lying in a hospital bed, you don’t want to wonder if your medicine was made by someone working 18-hour shifts in a basement with no ventilation.

Marsha Jentzsch

December 20, 2025 AT 01:03And you think this is the worst? Wait till you find out what’s in the pills. I’ve seen the reports. Heavy metals. Mold. Rat hair. The FDA doesn’t even inspect 10% of the labs overseas. They rely on ‘paper audits.’ PAPER AUDITS.

My sister’s blood pressure med? She started getting dizzy. Turned out the batch had 3x the lead allowed. She almost had a stroke. And who gets punished? No one. The company just says ‘oops’ and ships another batch.

They’re killing us. And they’re laughing all the way to the bank.

Janelle Moore

December 20, 2025 AT 05:53It’s all a lie. The government knows. They’ve known for 20 years. Why? Because they’re in bed with Big Pharma. They want us weak. Dependent. Easy to control. The shortages? They’re not accidents. They’re tests. To see how many people will die before we wake up.

Henry Marcus

December 20, 2025 AT 19:54They’re not just making drugs overseas-they’re making slaves. I read a whistleblower report. Workers in Gujarat are locked in dorms. No phones. No выход. They’re paid $2 a day to mix chemicals that’ll end up in your insulin. And the FDA? They give them a gold star.

And you think this is about ‘cost savings’? No. It’s about control. The same people who run the factories run the banks. Run the politicians. Run the news. They don’t want you healthy. They want you hooked.

Next time you fill a prescription, ask yourself: who really owns your life?

Carolyn Benson

December 22, 2025 AT 12:00There’s a deeper truth here. We’ve turned medicine into a commodity. We treat human life like a line item on a spreadsheet. We optimize for profit, not survival. We’ve forgotten that a drug isn’t a product-it’s a promise.

That promise was made to the sick, the old, the scared. And we broke it.

Resilience isn’t about building more factories. It’s about rebuilding our moral compass. We stopped caring when we stopped seeing the people behind the pills.

Until we do, nothing changes.

Chris porto

December 23, 2025 AT 13:42I get why companies went overseas. It made sense. But we forgot that systems need slack. Life needs buffer. The whole economy got obsessed with efficiency, but efficiency without resilience is just fragility with a fancy name.

Think of it like a bridge. You can build it super thin to save money. But if one bolt breaks, the whole thing falls. We built a bridge with no spare bolts.

Now we’re trying to add them back. Slowly. Too slowly. But at least we’re trying.

Adrienne Dagg

December 24, 2025 AT 08:38OMG I JUST REALIZED MY BLOOD PRESSURE MED IS FROM CHINA 😭 I’M SO SCARED. I’M GOING TO CALL MY DOCTOR RIGHT NOW. I DON’T WANT TO DIE BECAUSE SOMEONE IN SHANGHAI DIDN’T WASH THEIR HANDS. 😭😭😭

Erica Vest

December 24, 2025 AT 13:22Correction: the U.S. government allocated $1.5 billion under the CHIPS and Science Act, not the Inflation Reduction Act, for domestic API production. The IRA focused on insulin pricing and Medicare negotiations. Also, the 80% API import stat is accurate, but it’s closer to 85% for injectables and 90% for antibiotics. Source: FDA 2024 Drug Shortage Report, Table 3.

And blockchain adoption is actually 71%, not 65%. The 65% figure was from a 2023 Deloitte survey.

Chris Davidson

December 25, 2025 AT 08:44Reshoring is economically irrational. Labor costs are too high. Regulatory burdens too great. The global supply chain works because it is efficient. The problem is not outsourcing. The problem is lack of redundancy. Fix that not the geography.

Kinnaird Lynsey

December 27, 2025 AT 02:29It’s funny how we all get mad at China but never ask why we let this happen. We voted for the people who cut taxes for drug companies. We cheered when our prescriptions got cheaper. We didn’t want to think about the people making them.

Maybe the real failure isn’t overseas factories. It’s our willingness to ignore the cost.

I’m not blaming anyone. I’m just saying… we’re all in this together.

Glen Arreglo

December 28, 2025 AT 14:18I’ve been in logistics for 25 years. I’ve seen supply chains collapse. This one’s different. It’s not about trucks or ports. It’s about trust. When your medicine comes from a country you can’t talk to, can’t visit, can’t inspect-you’re not managing a supply chain. You’re gambling.

But here’s the good news: the shift is happening. Companies are waking up. Workers are being trained. Tech is helping. It’s slow. But it’s real.

We’re not going back to 1990. We’re building something better. Just give it time.