The U.S. generic drug market is changing faster than most people realize. If you’ve noticed fewer drug shortages lately-or if your prescription costs dropped suddenly-you’re seeing the results of major FDA rule changes from 2023 to 2025. These aren’t minor tweaks. They’re a full-scale rewrite of how generic drugs get approved, with one clear goal: keep life-saving medicines made in America.

Why the FDA Changed the Rules

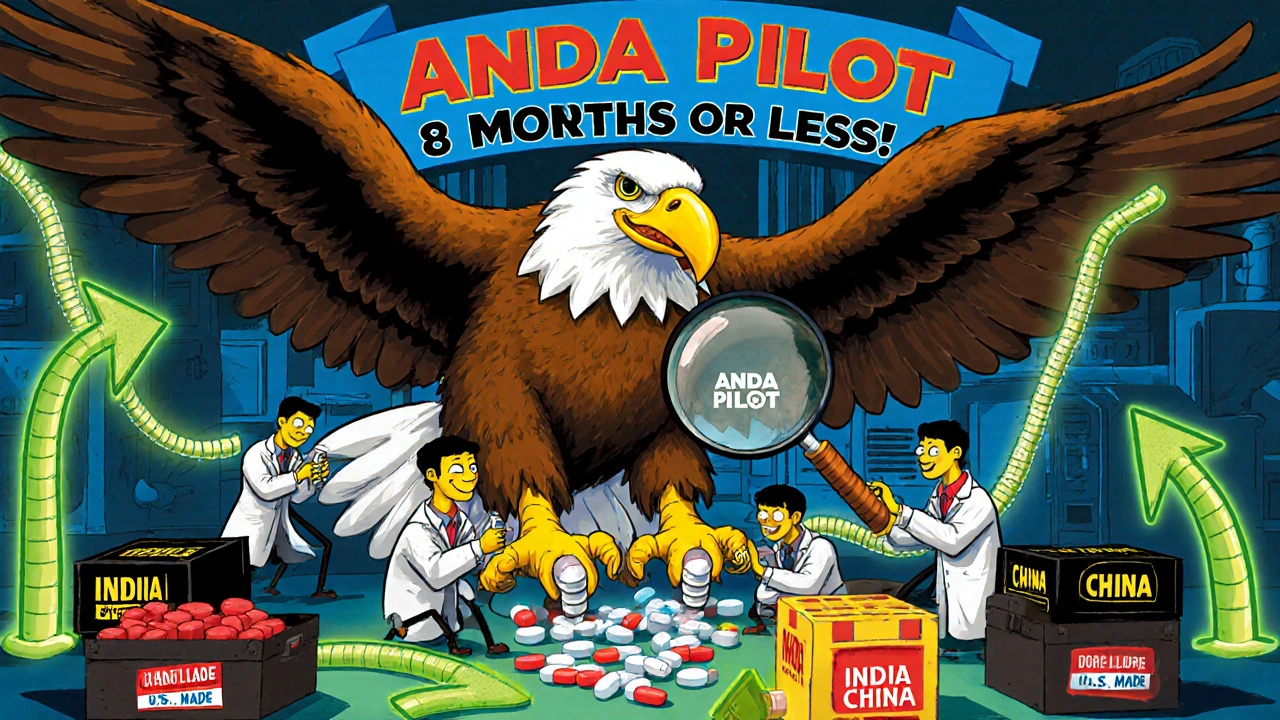

Before 2023, the FDA approved generic drugs based almost entirely on whether they matched the brand-name drug in strength, safety, and effectiveness. Where they were made didn’t matter much. That changed after the pandemic exposed how fragile the global supply chain was. Over half of all pharmaceuticals sold in the U.S. were manufactured overseas-mostly in India and China. When those countries faced lockdowns or export restrictions, hospitals ran out of critical drugs like antibiotics, anesthetics, and heart medications. In September 2023, Executive Order 14080 forced the FDA to act. The goal? Reduce dependence on foreign suppliers for active pharmaceutical ingredients (APIs) and finished products. By 2025, the FDA had launched the ANDA Prioritization Pilot Program, the biggest shift in generic drug approval since 2012. Now, if you make your generic drug in the U.S., you get faster approval. Period.How the ANDA Prioritization Pilot Works

The pilot program doesn’t change the science. A generic drug still has to prove it works the same as the brand. But now, the FDA gives priority to applications where everything-from the active ingredient to the final tablet-is made and tested in the U.S. There are four tiers of priority, based on how much of the process happens domestically:- Tier 1: 100% U.S. manufacturing and testing. Review target: 8 months.

- Tier 2: 75-99% U.S. components. Review target: 10 months.

- Tier 3: 50-74% U.S. components. Review target: 12 months.

- Tier 4: Less than 50%. Standard review: 12-15 months.

Who’s Winning-and Who’s Struggling

Big players like Teva and Mylan are jumping in. Teva’s regulatory team told the FDA’s industry forum that the 30-day initial review window cut their nimodipine solution launch time by eight months. That’s huge in a market where being first to market means capturing 70% of sales before competitors even start. But it’s not easy. Setting up a U.S. manufacturing facility for generics costs $120 million to $180 million. For a small company, that’s impossible. Even mid-sized firms face $1.2-$1.8 million extra per application just to verify U.S. sourcing and testing. The Association for Accessible Medicines found that 54% of manufacturers have started expanding U.S. capacity. But 31% have delayed product launches because of the cost. And 63% say finding reliable U.S. suppliers for complex APIs is a nightmare. The data shows who’s succeeding: manufacturers with fully domestic supply chains have a 92% approval rate under the pilot. Those relying on foreign manufacturing? Only 68%.

First Generics Are Driving Prices Down

The FDA has made it clear: they want more first generics. And they’re getting them. Through mid-2025, 9 first generics were approved-including azilsartan/chlorthalidone for high blood pressure and ivermectin tablets for parasitic infections. GoodRx data shows first generics hit the market 18.7% faster in 2025 than in 2024. And when they arrive, prices crash. On average, a first generic cuts the brand-name price by 78.3% within six months. That’s why the generic market hit $117.3 billion in 2024-6.2% growth from the year before. The catch? Domestic manufacturing adds cost. MedPAC estimates generic prices could rise 12-18% in the short term. But the FDA’s own analysis says those costs will drop after 3-5 years as U.S. capacity grows. By 2030, the Congressional Budget Office projects the program will save $4.2 billion a year by preventing drug shortages and emergency imports.What’s Still Missing

The pilot doesn’t cover everything. Complex generics-like transdermal patches, nasal sprays, and ophthalmic suspensions-are excluded for now. The FDA plans to add them in January 2026, but manufacturers are still waiting for detailed guidance. Bioequivalence testing is another hurdle. Even if you make the drug in the U.S., you still need to prove it behaves the same in the body. The FDA now requires testing at registered U.S. labs. But designing those studies for complex drugs is tricky. Forty-three percent of deficiency letters in 2025 cited bioequivalence issues. Documentation is the silent killer. Manufacturers report spending an average of 217 hours per application just to prove their ingredients and tests are U.S.-based. The FDA’s new digital inspection database cut facility verification time from 120 days to 45-but only if the paperwork is perfect.

Stephen Adeyanju

November 27, 2025 AT 10:01james thomas

November 28, 2025 AT 01:10Deborah Williams

November 29, 2025 AT 18:17Asia Roveda

November 29, 2025 AT 18:43Aaron Whong

December 1, 2025 AT 00:58Sanjay Menon

December 1, 2025 AT 20:55Rachel Whip

December 2, 2025 AT 19:44Ezequiel adrian

December 3, 2025 AT 20:22Ali Miller

December 5, 2025 AT 11:11JAY OKE

December 6, 2025 AT 00:01Amanda Wong

December 7, 2025 AT 05:23Cynthia Springer

December 8, 2025 AT 22:32Marissa Coratti

December 10, 2025 AT 02:21Joe bailey

December 10, 2025 AT 18:23Kaushik Das

December 11, 2025 AT 20:09